About CHC

CHC’s Three Business Segments Drive Strong Growth, Setting Record Backlog

Continental Holdings Corporation (CHC, TWSE: 3703) today announced 2024 financial results and the 2025 business outlook. In 2024, CHC delivered consolidated revenue of NT$30,701 million, operating profit of NT$1,249 million, and net profit of NT$1,175 million, resulting in earnings per share (EPS) of NT$1.43. A cash dividend of NT$1.05 per share will be distributed, marking the fifth consecutive year with a payout ratio exceeding 70%.

CHC CEO Cindy Chang said, “CHC’s three business segments continue to demonstrate strong growth momentum. By the end of 2024, Continental Engineering Corporation (CEC) and Continental Development Corporation (CDC) reached record-high revenue backlogs of NT$129.8 billion and NT$26.7 billion, respectively. Meanwhile, HDEC Corporation (HDEC) achieved record-high revenue and net profit since its establishment in 2006. These achievements further reinforce the Group’s foundation for long-term growth.”

The ongoing momentum of Sustainable Urbanization benefitted CHC’s core business sectors in 2024, with over 70% of CHC’s revenue aligned with the United Nations Sustainable Development Goals (SDGs), with its revenue backlog alignment exceeding 80% by year end.

CEC: Expanding Beyond Core Markets into New Areas, Supporting Future Growth with Technology

In 2024, CEC secured several key projects such as Taiwan’s largest urban renewal project Nangang Rail Yard Urban Renewal Project (Unit I), the Nangang Depot Social Housing Phase 2 Design and Build Project, the Taoyuan Urban District Railway Underground Project (Contract CJ17), together with the Taipei Metro Circular Line CF690B and CF670 Contracts. With these project wins, CEC’s backlog reached an all-time high of NT$129.8 billion.

In the civil engineering sector, while transportation infrastructure projects (MRT and Rail) remain CEC’s key focus, the company will also actively explore new opportunities such as utility service tunneling projects. In the building construction sector, CEC is broadening its scope beyond residential projects, expanding into social housing, mixed-use developments, and commercial buildings. In the M&E sector, the company is advancing prefabrication and modularization to boost efficiency and quality. CEC will also continue to enhance its Building Information Modeling (BIM) capabilities which include, construction simulation, clash detection, energy analysis, and embodied carbon reduction.

CDC: Diverse Urban and Product Portfolio, Catering to Next-Generation Homebuyers

In 2024, CDC achieved record-high annual sales and revenue backlog, with the latter reaching NT$26.7 billion, setting a solid foundation for future revenue and profit growth.

CDC secured key development projects across Taipei, New Taipei, Hsinchu, and Taichung in 2024. In 2025, it plans to launch five residential projects, including developments in Taipei’s Daan District (Xuefu Section), Nangang District (Nangang Section), and Xinyi District (Yaxiang Section), as well as projects in Hsinchu County’s Zhubei City (Daxue Section) and Taichung’s Nantun District (Fengxi Section), with a total estimated sales value of NT$39.33 billion. To meet market demand, 79% of CDC’s 2025 project launches will feature units ranging from 30 to 50 ping.

With a focus on sustainable urbanization, 80% of CDC’s newly permitted or planned projects in 2024 and beyond involve urban renewal or redevelopment of aging buildings. Additionally, 95% of projects incorporate green building design. Looking ahead, CDC will continue focusing on development opportunities in Taipei, New Taipei, Taichung, Hsinchu, and Taoyuan.

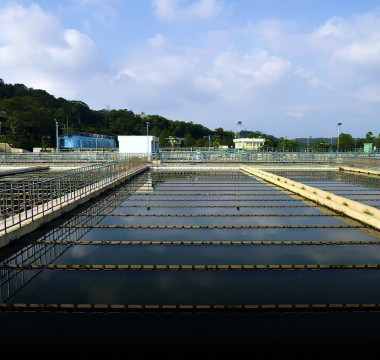

HDEC: Strengthening Core Water Treatment Services, Expanding into Renewable Energy, and Enhancing Operational Efficiency Through Technology

HDEC achieved record-high net profit in 2024, with its contribution to CHC’s overall net profit increase to 39%.

After being awarded the Southern Taiwan Science Park (STSP) Chiayi Campus Wastewater Treatment Plant New Construction Project, HDEC’s backlog reached NT$64.7 billion. Several key projects, including the Kaohsiung Ciaotou Wastewater Reclamation Plant, STSP Chiayi Campus Wastewater Treatment Plant, and the Tainan Chengxi Incineration Plant, are expected to begin operations within the next two years, ensuring stable recurring revenue.

As HDEC’s projects grow in number and scale, the company has implemented real-time operational dashboards to monitor plant performance, leveraging technology to enhance decision-making efficiency and reduce operating expenses.