About CHC

CHC Achieves NT$2.09 EPS for FY2023, Sets New Backlog Record

Three Business Segments Form a Balanced Portfolio

Continental Holdings Corporation (CHC) today (March 27th) conducted a briefing on 2023 financial results and its 2024 business plan. For the fiscal year 2023, the company posted consolidated revenue of NT$30,607 million, net profit of NT$1,717 million, and earnings per share of NT$2.09. A cash dividend of NT$1.50 per share will be distributed, implying a dividend yield of approximately 5.1%.

CHC CEO Cindy Chang said, “CHC’s three business segments(*) have all delivered consistent growth over the past few years, with the most significant increase in profitability coming from CEC. Additionally, CEC and HDEC both achieved record-high revenue backlogs in 2023. From the perspective of the investment portfolio, the three business segments are more balanced in terms of profit contribution and business development, helping solidify the Group’s overall development.”

“Continuing with the theme of ‘Sustainable Urbanization’, all three business segments under CHC actively participate in projects such as railway engineering, urban renewal, water treatment, and renewable energy. Currently, more than 60% of CHC’s revenue and over 80% of its revenue backlog are aligned with the United Nations Sustainable Development Goals (SDGs).”

CEC: Record-high backlog while enhancing technology for greater efficiency

At the end of 2023, CEC achieved a record-high backlog of NT$80.1 billion, equivalent to 3.8 times its 2023 revenue. CEC secured several major new projects in 2023, including the Taipei Metro Circular Line Southern Section CF670A Contract and the Jiantan Station Transit Facility Utilized for Multi-Purpose Design Build Project. Furthermore, in early 2024, CEC won the Taoyuan Railway Undergrounding CJ17 Contract valued at NT$15.577 billion and the Nangang Rail Yard Urban Renewal Project (Unit I) with a contract value of NT$10.71 billion.

For civil business, transportation infrastructure projects (metro, railways) remain a focus for CEC, though CEC also seeks opportunities from energy and other emerging fields to drive earnings growth. In the building business, in addition to its expertise in residential projects, CEC will also pursue mixed-use developments, commercial buildings, and other projects. Meanwhile, CEC is enhancing its capabilities in Building Information Modeling (BIM) and integrating new technologies to improve engineering efficiency. The company is also implementing measures to reduce carbon emissions and enhance energy efficiency across site offices as part of its ongoing sustainability initiatives.

CDC: Expanding product portfolio, pursuing new land development projects

In 2023, CDC secured new land development projects in Taipei’s Nangang and Daan districts, and Hsinchu County’s Zhubei district. Each project lays a solid foundation for future revenue growth. In 2024, CDC’s upcoming residential projects include “Metropolitan Village (耑岫)” (Taipei’s Daan district), “Green Utopia (豐莚)” (Taichung’s Beitun district), “Poetic Yard (耑芃)” (New Taipei’s Banqiao district), as well as another project in New Taipei’s Banqiao district , with a total sales value estimated at NT$17.7 billion.

CDC continues to diversify its product portfolio by introducing small- and medium-sized residential units, enhancing its portfolio with green, smart buildings, and developing new commercial properties. CDC’s primary focus includes Taipei, New Taipei, Taichung, Kaohsiung, and Hsinchu.

Additionally, the company announced on March 25th a public auction with a base price of NT$4.15 billion for hotel floors 1-9 of “Beautiful Journey (琢豐),” located at Nanjing-Songjiang interaction in Taipei. As for overseas endeavors, CDC will focus on maintaining stable hotel operations, increasing occupancy rates, and adjusting sales strategies based on market conditions for its residential properties.

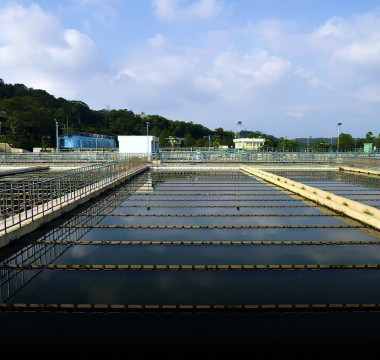

HDEC: Venturing into the renewable energy market, ensuring long-term revenue stability

In 2023, HDEC successfully entered the waste treatment and renewable energy markets, resulting in a substantial increase in revenue backlog. By the end of 2023, the backlog had reached a record-high value of NT$69.8 billion – a 55% growth compared to 2022 and equivalent to 14.6 times its 2023 revenue.

Following the successful operations of the Tamsui , Fengshan, and Linhai Water Resources Centers, Anping, Puding, and Zhongli centers have also commenced operations, contributing to the company’s stable, long-term revenue stream. In 2024, HDEC plans to further expand its water reclamation operations by venturing into the high-end water treatment market while also further developing waste treatment and bioenergy markets.

*CHC’s three business segments refer to Construction Engineering Business (Continental Engineering Corporation, “CEC”), Real Estate Development Business (Continental Development Corporation, “CDC”), and Environmental Project Development & Water Treatment Business (HDEC Corporation, “HDEC”).