About CHC

Continental Holdings Corporation (TWSE: 3703) Reported FY2024 EPS of NT$1.43, Declared Cash Dividend of $1.05 per Share

Continental Holdings Corporation (CHC) today (March 5th) reported its financial results for twelve months ended December 31, 2024 and announced earnings distribution. For full year of 2024, the Company delivered consolidated revenue of NT$30,701M, operating profit of NT$1,249M, net profit of NT$1,175M, and earnings per share of NT$1.43. The Board has approved the distribution of a NT$1.05 per share cash dividend, representing a payout ratio of 73.6%.

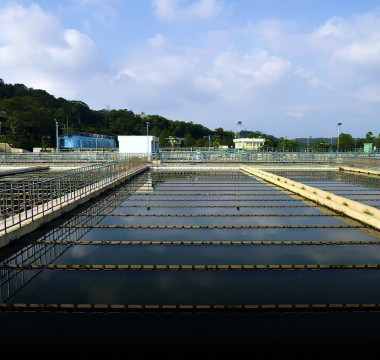

CHC’s consolidated revenue for full year 2024 was in line with revenue in 2023. Among our three business segments, revenue of Construction Engineering Business (Continental Engineering Corporation) remained on par compared with revenue in 2023. Despite a decline in revenue of Real Estate Development Business (Continental Development Corporation) from new residential project handovers compared to the prior year, Environmental Project Development & Water Treatment Business (HDEC Corporation) achieved a record-high revenue with a 64.7% year-on-year growth. Full year gross margin decreased by 1.9 percentage points compared to the previous year, mainly due to a lower profit contribution from Real Estate Development Business. With a decrease in gross margin compared to the prior year, CHC reported a year-over-year decrease in operating profit and net profit for full year 2024. Net profit of Environmental Project Development and Water Treatment Business was at historic high.

CHC maintained a solid revenue backlog in the three business segments. As of December 31, 2024, revenue backlog for Construction Engineering Business set a new historical high at NT$129.8B, translating to 6.2 times of its 2024 full year revenue. Revenue backlog of Real Estate Development Business reached a record high of NT$26.7B, equivalent to 5.4 times of its 2024 full year revenue. Revenue backlog of Environmental Project Development & Water Treatment Business is NT$64.7B, and was 8.2 times of its 2024 full year revenue.